Multi-Generational Estate & Asset Protection Planning

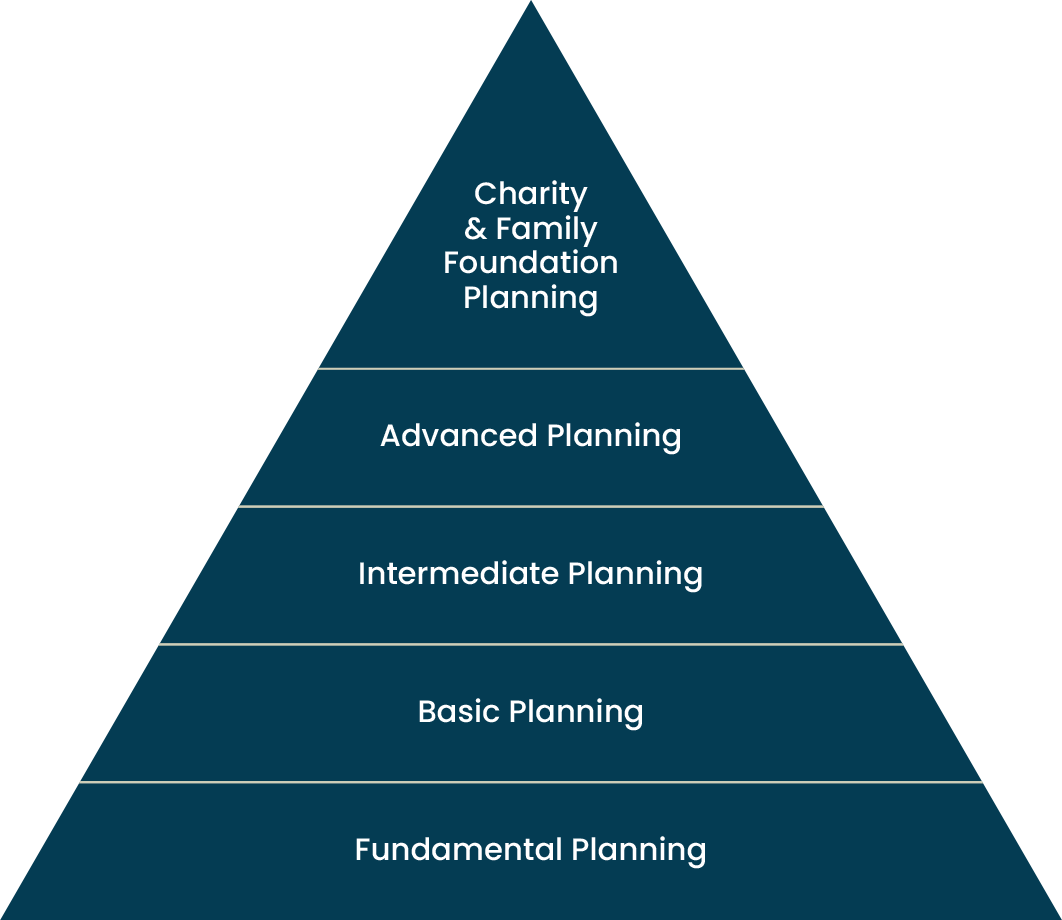

As your estate has grown, decisions on how you grow, protect, and ultimately distribute your estate to be fully aligned with your legacy plan may have been neglected.

Early in life, your estate plan was designed to protect your family if you were not around. Now, it may need to be revised in order to grow, protect, and distribute your estate to family or charities. In addition, as estates grow and become more complex, you will have to also contend with that pesky "heir," Uncle Sam. Paying estate and transfer taxes can be substantially reduced or even eliminated with thoughtful planning.